Reach tomorrow's customers today.

MODIV Peak is here

MODIV Peak is an always-on research tool purpose-built for travel and hospitality marketers. Instead of guessing at how to engage your future customers - ask them.

Launch your next campaign, powered by real future travel intent and need.

MODIV Peak gives you demand based foresight into how and where to market to travelers and planners who are actively considering trips to your destination. It’s a cheat sheet for demand—designed to help you optimize campaigns, close revenue gaps, and make more confident marketing decisions.

Whether you’re targeting:

-

Golfers, wellness travelers, or life-event celebrators

-

International travelers or group travel planners

-

Quick wins in need periods or long-term campaign plays

MODIV Peak tells you:

-

Who’s coming to your market

-

Why they’re coming

-

What influences their lodging decisions

-

Where they consume media

-

What platforms deserve your spend

-

What your messaging should focus on and why

Get the traveler intel you need, before your next campaign launches

MODIV Peak gives you real-time insight into how and where to market to travelers who are actively planning trips to your destination.

It’s a cheat sheet for demand—designed to help you optimize campaigns, close revenue gaps, and make more confident marketing decisions.

Find answers to important questions in your Peak report

Know Your Customer, the MODIV way. Peak currently has two traveler categories: Leisure and Business Travelers and Event Planners, that helps dictate what data to provide.

In the case of Leisure and Business Travelers, you can expect the following data:

The Dominant Demographics show the gender and age cohorts likely to travel to your market. The segments listed here should be considered dominant and leveraged when setting up target profiles in digital media platforms.

The Top Five Traveler Profiles represent the behavioral and attitudinal ”head-space” of the travelers most likely to be planning a trip to your market.

MODIV Peak tests more than 65 travel patterns, preferences, perceptions, and behaviors with each respondent. For the most part, you can assume these travelers would maintain this profile regardless of destination or occasion.

The Top Five Trip Types shows the five most common reasons travelers will head to your market in the next 120 days.

MODIV Peak takes into consideration both occasion and specific hotel criteria that are unique to the trip being planned. It tests more than 45 different stay occasions and more than 345 hotel attributes to arrive at these trip types.

Knowing these trip types can help creative teams begin to identify what messaging and imagery they should lean on the most when developing campaigns.

Share of Attention by Media Category offers a snapshot of the broad media categories most consumed by travelers heading to your market.

The more complete and balanced the dark blue shape, the more media of all kinds travelers consume. Where the blue shape stretches out and points to a particular media type, this can be interpreted as a category of media that is more relevant and engaging to travelers than the others.

Where a particular media category is capturing more attention, it should be explored as a more efficient category to invest media budgets into.

The Digital Platform Priority matrix is designed to reveal the specific digital platforms that warrant a larger media budget than others.

MODIV Peak tests over 55 digital platforms, sites, and apps (customized by region). The results of these tests score each platform against three criteria:

- How much time do respondents spend on the platform?

- How trusted is the platform by respondents?

- What is the barrier to media entry onto the platform based on costs, competitiveness, and the type of content that needs to be created to fit the platform’s requirements?

MODIV Peak then chooses the highest-performing platforms based on how travelers planning for your market score them. The chart shows the leading platforms in larger blue circles.

This chart should be leveraged when developing channel strategies and allocating funding.

The Planning and Booking Sources visual provides a snapshot of the hotel information sources most used by travelersplanning to visit your market.

The dark blue bars represent the sources most likely to be where travelers are researching and will make their bookings, while the red bars represent the sources least likely to be where travelers will make their bookings.

Knowing the most used sources can help set media budgets where applicable.

Travelers planning a trip to your market will likely base their final lodging decision on these five hotel offerings, amenities, or attributes listed in Top “Deciding Factors”.

The red line in this visual represents the statistical threshold, based on MODIV Peak’s models, for when a hotel attribute is too weak (below the red line) to be considered part of the final decision process.

Knowing these leading attributes allows creative teams to identify the priority areas to highlight as campaigns are created.

To get the data for the Top Creative Directions for Engagement, MODIV Peak tests over 105 advertising themes, aesthetics, and visuals to determine how engaging they are to travelers planning to visit your market.

It also tests 345 different hotel attributes for their relevance to the travelers' upcoming stay. Finally, a model merges the results of both tests and renders creative themes and messaging platforms likely to resonate with and present the information that travelers planning to travel to your market are looking for.

Each “campaign” concept is weighted for how many incoming travelers it will likely engage with. These concepts are intended as starting places for creative and content teams as they plan for digital campaigns.

Meanwhile, Peak's Event Planners category offers the following information:

The Planner Type and Tenure show the self-categorized planner type and tenure cohorts most seeking meeting and event space in your market. The segments listed here should be dominant and leveraged when targeting specific meeting planner profiles with marketing.

We see that various event types have different planner personas. In many cases, non-professional planners are the dominant profile for specific types of events. Sales processes should be adjusted accordingly to account for experience differences, need for turn-key services, etc.

Deploying the right salesperson against a specific planner persona can help with both conversion and customer satisfaction.

The Leading Planner Profiles represent the behavioral and attitudinal "head-space" of the planners most likely to be planning a meeting or event in your market.

MODIV Peak tests more than 35 planner patternspreferences, perceptions, and behaviors with each respondent. For the most part, you can assume these travelers would maintain this profile regardless of destination or occasion.

MODIV Peak tests more than 65 travel patterns, preferences, perceptions, and behaviors with each respondent. For the most part, you can assume these travelers would maintain this profile regardless of destination or occasion.

How to use itWhat motivates a planner, what gets them excited? What do they want their attendees to walk away with? These answers span different planner personas, so pick a leading profile that aligns with a value prop you can meet.

Use this for:- Better marketing messaging

- Development of talk tracks for sales interaction

- Areas to focus on in the RFP response when differentiating yourself

In Meeting Type and Level of Service, we plot each planner type against the size of the event they're planning (based on estimated nights on peak) and against the level of service they are budgeting for and planning on. Looking at the demand for event space through these lenses allows you to quickly assess the texture of the opportunity that is coming to your market in the next six to twelve months.

Use this view to better understand the hotel brands you'll likely be competing for (based on the level of service demand) and to understand what meeting size to engage and which planner types about. Both insights can give you guidance on how to position your venues and what to focus on.

Find the most common reasons corporate planners seek venues in your market in the Top Corporate Meetings section.

MODIV Peak takes into consideration both occasion and specific hotel criteria that are unique to the event being planned. It tests over 25 corporate meeting occasions and over 225 hotel attributes to arrive at these meeting types.

Knowing the specific reasons and goals behind a large segment of meetings coming to your market enables you to build specific packages to meet planner needs.

Details related to media, menus, activities, wellness, etc., can be combined to create a unique offering that stands out, yet is easy for your sales team to pitch and your services team to deliver over and over, creating strong customer success stories and word of mouth earned media.

Planners preparing for an event in your market will likely base their final venue decision on the five groups and meeting-centric hotel offerings, amenities, or attributes included in the Top Features to Focus on section.

The red line in this visual represents the statistical threshold, based on MODIV Peak's models, for when a hotel attribute is too weak (below the red line) to be considered part of the final decision process.

Everyone knows price, availability and location are key factors, but what other features can be focused on to differentiate from the fierce competitor nearby?

Knowing these leading attributes allows creative teams to identify the priority areas to highlight as campaigns are created

Use these to build your sales team capabilities and focus your offerings.

To get data on the Top Creative Directions for Engagement, MODIV Peak tests over 105 advertising themes, aesthetics, and visuals to determine how engaging they are to meetings and events planners looking for venues in your market. It also tests 225 hotel attributes for relevance to the planners' upcoming events. Finally, a model merges the results of both tests and renders creative themes and messaging platforms likely to resonate with the planners who are planning events in your market.

Each "campaign" concept is weighted for how many planners it will likely engage with. The concepts are intended to be used as starting places for creative and content teams as the plan for planner-focused marketing campaigns.

Marketing teams can leverage these insights to tailor messaging, offers, imagery, etc., in their B2B marketing campaigns, owned media, website, etc.

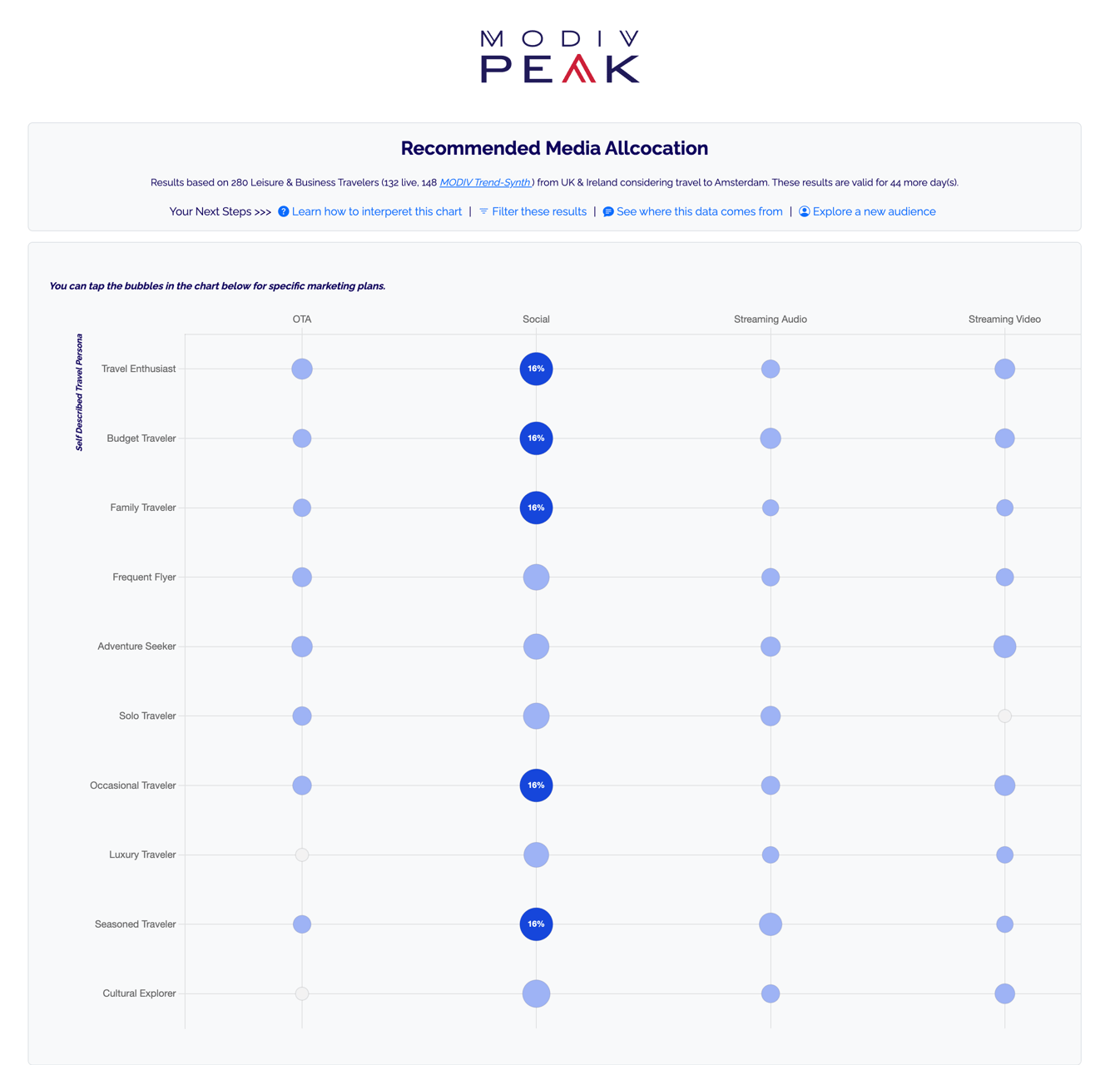

Marketing Channel Effectiveness is a visual representation of how potential marketing channels align with the different planner types that are looking for meeting and event space in your market.

We score each combination of planner type and channel on a scale of 0 to 100. This score reflects channel affectivess and is based on how engaged the planner type would be with content in that channel, how much they will trust it, and how likely they are to act on the content they see.

Tip: The larger and brighter the bubble, the more effective the channel. Use this view to determine where to invest media and resources to reach planners. Rows or columns with multiple bright blue circles in them are audiences or channels from which you can expect heightened content engagement.

How Peak Works

We pull a statistically valid sample of customer response data from the MODIV Peak database, with over 130 different marketing related data points.

You use our commercially focused web app to explore profiles, motivators, media consumption patterns, and campaign guidance.

Use the findings to launch smarter, faster, and more targeted campaigns.

How MODIV Peak Works

Define your customer segment and destination—MODIV builds a custom query.

We field a 25-question survey across a statistically valid traveler sample.

>You receive traveler profiles, trip motivators, media consumption patterns, and campaign-ready creative guidance.

>Use the findings to launch smarter, faster, and more targeted campaigns.

A Glimpse Into Peak’s Demand-based Marketing Guidance

View a sample report below.

Why Teams Love Peak

| ✓ | Combines historical performance with forward-looking demand signals |

| ✓ | Accelerates go-to-market timelines |

| ✓ | Unlocks segment- and market-specific quick wins |

| ✓ | Supports smarter budget allocation by channel and message |

| ✓ | B2C and B2B ready—ideal for leisure, group, and event marketing |

Ready to see what Peak can do?

Get access to the MODIV Peak platform and start marketing to real, future demand.